Loading

Get Collateral Inspection Report

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the COLLATERAL INSPECTION REPORT online

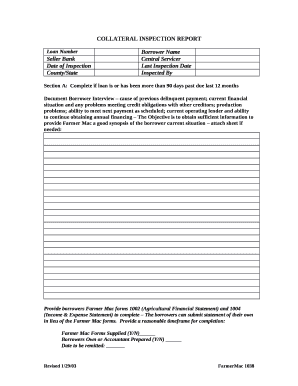

Filling out the Collateral Inspection Report online is a straightforward process that allows you to provide essential information regarding a loan inspection. This guide will walk you through each section of the form to ensure all necessary details are clearly and accurately completed.

Follow the steps to accurately complete the Collateral Inspection Report.

- Press the ‘Get Form’ button to access the form and open it in your preferred browser.

- Enter the loan number at the top of the form, ensuring it is correct to avoid any issues during processing.

- Fill in the seller bank and date of inspection. Include the county and state where the inspection took place.

- Provide the borrower's name and the central servicer’s name. Additionally, record the last inspection date and the name of the person conducting the inspection.

- If the loan has been more than 90 days past due within the last 12 months, complete Section A. Conduct a borrower interview to assess their financial situation, cause of delinquency, and ability to meet future payment obligations.

- Attach any necessary documentation or additional sheets to provide a comprehensive overview of the borrower's circumstances.

- Indicate whether Farmer Mac forms 1002 and 1004 were supplied, or if the borrower will provide their own financial statements. Specify a date for when these documents need to be submitted.

- Proceed to Section B. List the summary of crops planted, including crop type, acres, condition, age, and any comments related to the crops.

- Discuss existing and potential problems related to the crops, such as maintenance issues, irrigation, and supply of resources.

- Fill out the environmental compliance section, indicating whether there are any underground or above-ground tanks, garbage dumps, or hazardous materials present.

- Provide details and recommendations if there are any concerns noted in the environmental compliance section.

- Conclude by discussing property value trends and any concerns related to marketing and salability of the collateral property.

- Complete the signature fields for the borrower name, loan number, inspector's name, and date. Also, note the number of pictures attached.

- After reviewing all entries for accuracy, save your changes, and choose to download, print, or share the completed form as needed.

Complete your documentation online today with confidence.

It involves checking the related documentation to help you ensure that the Letter of Credit transaction is valid for the given order.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.