Loading

Get Financial Game Plan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Financial Game Plan online

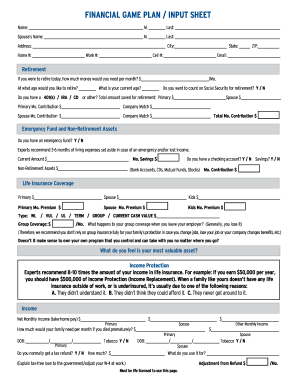

Completing the Financial Game Plan online is an essential step towards understanding your financial needs and creating a solid foundation for your future financial security. This guide provides clear, step-by-step instructions on how to fill out each section of the form effectively.

Follow the steps to successfully complete your Financial Game Plan.

- Press the ‘Get Form’ button to retrieve the Financial Game Plan document and open it in the editor.

- Begin by entering your personal information, including your full name, spouse's name (if applicable), and your complete address. Ensure all contact numbers and email addresses are accurate for effective communication.

- In the 'Retirement' section, specify how much money you would need per month if you were to retire today and indicate your current and desired retirement age. Decide if you plan to rely on Social Security and list your retirement savings balances and contributions.

- For the 'Emergency Fund and Non-Retirement Assets' section, indicate whether you have an emergency fund, the current amount saved, and monthly contributions. Provide details on your checking and savings accounts if applicable.

- Under 'Life Insurance Coverage', fill in the coverage amounts for yourself, your spouse, and your children, along with the monthly premiums. Choose the type of life insurance policy you have and any associated group coverage.

- In the 'Income' section, list all sources of your net monthly income, including your spouse's income. Calculate the amount your family would need per month in the event of premature death.

- For 'Education for Children', indicate whether you believe a college education is important for your children, and if so, provide the amount saved for their education and any monthly contributions.

- Complete the 'Legal Protection' section by specifying whether you currently have a will and if you would like to have one if affordable.

- In the 'Debt' section, document your consumer debts and mortgage balances, and reflect on your current debt management situation. Answer related questions regarding debt services you may be using.

- Finally, verify all the information provided in the questionnaire, sign as needed, and complete the form. You can then save your changes, download or print the document, or share it with relevant parties.

Start completing your Financial Game Plan online today to take control of your financial future!

8 Components of a Good Financial Plan Financial goals. ... Net worth statement. ... Budget and cash flow planning. ... Debt management plan. ... Retirement plan. ... Emergency funds. ... Insurance coverage. ... Estate plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.