Loading

Get Ga D3-dcp 2006-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA D3-DCP online

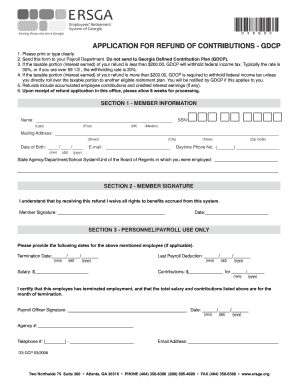

The GA D3-DCP form, which is the application for refund of contributions, is designed for individuals seeking to reclaim their accumulated employee contributions from the Georgia Defined Contribution Plan. This guide will provide step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the GA D3-DCP easily and effectively.

- To start, press the ‘Get Form’ button to access the GA D3-DCP form and open it in your preferred editing tool.

- In Section 1, enter your personal information clearly. Fill in your full name, Social Security Number, mailing address, date of birth, email, and daytime phone number.

- Indicate the state agency, department, school system, or unit of the Board of Regents where you were employed.

- In Section 2, review the statement regarding the waiver of rights to benefits and ensure that you comprehend its implications. Sign and date the section to confirm your understanding.

- Section 3 is designated for personnel or payroll use only. If applicable, enter the employee's termination date, last payroll deduction date, salary, and contributions.

- Have the payroll officer certify the employment termination by signing the section and recording the date. Ensure that the agency number, telephone number, and email address are filled in correctly.

- Once all sections are completed, review the form for accuracy. You can then save your changes, download the completed form, print it, or share it as needed.

Begin completing your GA D3-DCP online today!

On your tax return, GA D3-DCP refers to the deferred compensation you reported in the corresponding sections. This information is vital for calculating your taxable income accurately. Additionally, using resources like US Legal Forms can help you navigate reporting and ensure all details regarding DCP are properly addressed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.