Loading

Get Bov Fatca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bov Fatca online

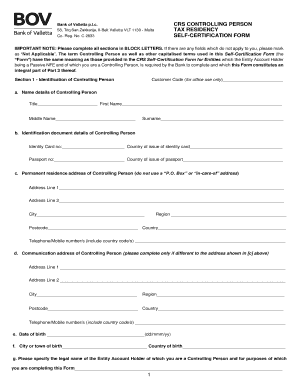

The Bov Fatca form is essential for individuals classified as Controlling Persons, required to declare information for tax compliance. This guide will provide users with clear instructions to help complete the form online accurately.

Follow the steps to fill out the Bov Fatca online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the identification details of the Controlling Person in Section 1. This includes name details, identification document details, permanent residence address, and communication address if different.

- Proceed to Section 2 and specify the countries or jurisdictions where the Controlling Person is resident for tax purposes. Include the Taxpayer Identification Number (TIN) for each applicable country.

- In Section 3, identify the type of Controlling Person by selecting the appropriate status box. This may involve control by ownership, senior management position, or other specified means.

- Finally, complete Section 4 by signing the declaration, including the date, and providing full name and capacity if applicable. Verify all information for accuracy before submission.

Start filling out your Bov Fatca form online today to ensure compliance.

If you must file Form 8938 and do not do so, you may be subject to penalties: a $10,000 failure to file penalty, an additional penalty of up to $50,000 for continued failure to file after IRS notification, and a 40 percent penalty on an understatement of tax attributable to non-disclosed assets.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.