Loading

Get Iht205 Form Printable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht205 Form Printable online

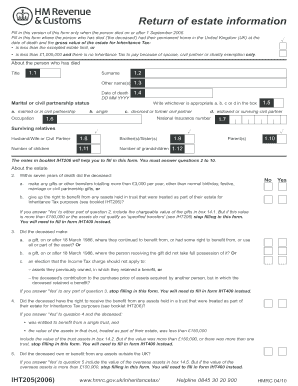

The Iht205 Form Printable is a crucial document for reporting estate information following a person's death in the UK. This guide provides you with clear instructions on how to accurately complete this form online, ensuring you meet all necessary requirements.

Follow the steps to complete the form correctly.

- Press the ‘Get Form’ button to obtain the Iht205 form and open it in your preferred digital editor.

- Begin by filling out the section 'About the person who has died.' Ensure to complete fields such as surname, other names, date of death, and marital or civil partnership status.

- Provide the National Insurance number and details of surviving relatives. Be precise when entering the number of children, grandchildren, and any additional relatives.

- Move on to the 'About the estate' section. You will need to respond to questions related to gifts made by the deceased within seven years prior to their death. Choose 'Yes' or 'No' based on your situation.

- Continue answering the subsequent questions regarding trusts, overseas assets, life insurance, pensions, and other relevant parts of the estate. Each question may lead you to additional instructions or necessitate completing form IHT400 instead.

- Complete section 13 regarding the deceased's assets. Be sure to include all items which were part of the estate at the time of death, providing gross values before any deductions for exemptions or relief.

- Fill out the gifts and lifetime transfers, followed by any debts of the estate, ensuring you accurately calculate totals where necessary.

- In the final sections, include any additional information requested and note any exemptions applicable under UK tax regulations.

- Once all sections are completed, review your information for accuracy. Save changes, then download, print, or share the completed form as needed.

Complete the Iht205 form online to ensure timely and accurate estate management.

If there is any inheritance tax to pay on the deceased's estate, you will need to obtain an inheritance tax reference number and payslip from HMRC. You can apply for this by completing Form IHT422 and sending it to HMRC together with Form IHT400.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.