Loading

Get Manulife One Account Or Preferred Rate Mortgage Application - Miimortgagegroup

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Manulife One Account or Preferred Rate Mortgage Application - Miimortgagegroup online

Filling out the Manulife One Account or Preferred Rate Mortgage Application online can seem daunting, but with a clear guide, you can navigate the process smoothly. This document requires specific information related to your finances, property, and personal details, and following each step will help ensure a successful submission.

Follow the steps to complete your application accurately.

- Press the ‘Get Form’ button to obtain the application and open it in the editor.

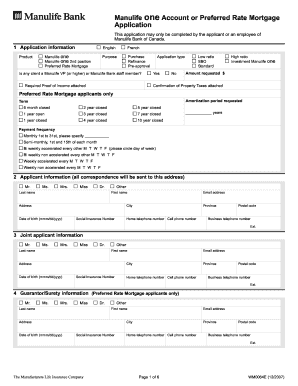

- Begin with section 1, where you will select the type of product you are applying for: Manulife One, Manulife One 2nd position, or Preferred Rate Mortgage. Indicate your purpose for the application — whether it's a purchase, refinance, or pre-approval.

- In section 2, provide your personal information. This includes your title (Mr., Ms., etc.), first name, last name, email address, phone numbers, and date of birth. Ensure all details are correct for correspondence purposes.

- If applicable, complete section 3 for joint applicants. Include the same details as required in section 2 for your partner.

- If you are applying for a Preferred Rate Mortgage, proceed to section 4 to provide information about the guarantor or surety. Fill in their details similarly to the previous sections.

- Move to section 5 to give consent for Equifax to access your credit report, which will require you to state the names of clients and the consent dates and times.

- In section 6, provide detailed information about your application, including your previous insurer account number, bridge financing status, and if the proceeds of the loan will benefit another person.

- Section 7 asks for property details. Indicate the dwelling type, address, purchase price, and confirm if taxes are current. Provide any additional details regarding the property as required.

- Fill section 8 with compliance information, including marital status, number of dependents, and residential status. Verify if you or any joint applicants have applied for landed immigrant status or have any bankruptcy history.

- In section 9, state your income details, including gross annual income, occupation, and employer information. Ensure to attach required proof of income documents.

- Section 10 gathers your lawyer's details, including name, address, and contact information.

- Complete section 11 by providing details of your banking consultant or advisor, if applicable.

- In section 12, you may choose to request separate disclosure documents if you wish.

- Review the declaration, authorizations, and consents in section 13 carefully and provide your signature and date of application completion.

- Once all sections are completed, save your changes. You then have the option to download, print, or share the filled application.

Complete your Manulife One Account or Preferred Rate Mortgage Application online to get started on your financial journey.

Related links form

Rates. Our Access Lines of Credit offers a competitive interest rate on the money you borrow. Access Line of Credit is available with a credit limit of $25,000 to $100,000 while Access Line of Credit Plus has an available credit limit of $100,000 plus.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.