Loading

Get Contractors39 Bexcise Tax Returnb - State Of South Dakota - State Sd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

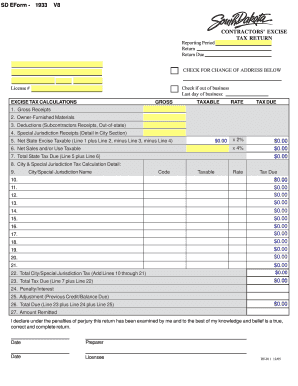

How to fill out the contractors’ excise tax return - State of South Dakota online

Completing the contractors’ excise tax return is essential for businesses operating in South Dakota. This guide will provide you with clear instructions to successfully fill out the form online, ensuring you meet all necessary requirements.

Follow the steps to accurately complete the tax return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the reporting period section. Enter the relevant reporting period for which you are filing the return. Ensure it corresponds to the correct dates of business activity.

- In the next section, if you have had a change of address, check the appropriate box. If applicable, provide the last day your business operated.

- Input your license number in the designated field. This number is essential for identifying your business in tax records.

- Proceed to the excise tax calculations. Start by entering your gross receipts in the designated line. This figure should represent your total revenue from taxable activities.

- Next, input any owner-furnished materials. This should include materials that you provided to projects that are subject to excise tax.

- In the deductions section, include any amounts for subcontractor receipts and out-of-state activities. Ensure all sources of deductions are supported by relevant documentation.

- If applicable, report any special jurisdiction receipts in the city section. This requires detailing where the taxable activities took place.

- Calculate your net state excise taxable amount using the provided formula (Line 1 plus Line 2, minus Line 3, minus Line 4).

- Record the net sales and/or use taxable amounts, followed by calculating the total state tax due (Line 5 plus Line 6).

- Continue with calculations for city and special jurisdiction tax, ensuring to input the tax due amounts for different jurisdictions where applicable.

- After calculating all taxes due, review the penalties and interest sections for any applicable charges based on late payments or outstanding balances.

- At the end of the form, you will find a section to declare that the return has been examined. Both the preparer and licensee must sign this declaration.

- Finally, you can save changes, download, print, or share the completed form as needed.

Complete your contractors’ excise tax return online to ensure compliance and potentially benefit from timely filing allowances.

While there is no state withholding tax in South Dakota, employers do need to pay state unemployment insurance taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.