Loading

Get Completing Pa Uc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the COMPLETING PA UC online

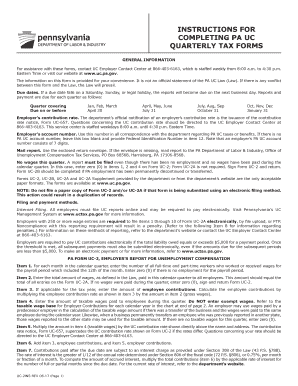

This guide provides clear directions for completing the PA UC forms online, ensuring that users can easily navigate each section and field. Whether you are a seasoned employer or new to the process, this guide aims to make your filing experience straightforward and efficient.

Follow the steps to complete the online PA UC forms.

- Press the ‘Get Form’ button to access the form and open it in your editor of choice.

- Begin with the first section of the form which requires the employer's account number. If you do not have a PA UC account number, leave this box blank and provide your Federal Identification Number as instructed.

- For each month in the quarterly reporting period, enter the number of full-time and part-time employees who received wages. If no wages were paid, enter zero.

- In the wage total section, input the total wages paid during the quarter to all employees. If no wages were paid, indicate zero and ensure to sign and return the report.

- Complete any applicable sections such as employee contributions by calculating based on the defined contribution rate and gross wages from the previous step.

- If applicable, fill in the amount of taxable wages paid during the quarter, ensuring no exempt wages are included. If there were none, record zero.

- Calculate the total contributions by adding employee contributions and employer contributions together for the reporting period.

- Ensure you enter a signature from an authorized individual, date the report, and provide the individual's title and business contact number.

- Review all entries for accuracy and completeness, then prepare to save your changes and finalize your submission.

- Once you are done, you may save the changes, download, print, or share the completed form as needed.

We encourage you to complete your forms online for a more efficient filing process.

To check your claims, payment history, and benefit status, you can review the section above or call 888-255-4728 for more details. Just remember that once you file your initial application for UC benefits, you will receive three separate mailings within 10 days time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.