Loading

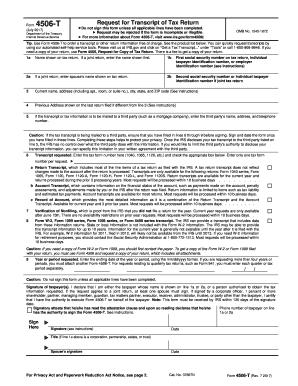

Get 2018060301request For Transcript Of Tax Return (sba 4506-t)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2018060301 Request for Transcript of Tax Return (SBA 4506-T) online

Filling out the 2018060301 Request for Transcript of Tax Return (SBA 4506-T) form online can streamline the process of obtaining your tax return information. This guide will provide you with step-by-step instructions to successfully complete the form.

Follow the steps to fill out the form online efficiently.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In line 1a, enter the name shown on your tax return. For joint returns, list the name that appears first.

- If applicable, enter your spouse’s name on line 2a if you filed a joint return and provide their social security number or individual taxpayer identification number in line 2b.

- If your previous address differs from the current address, enter it on line 4 as indicated.

- In line 6, enter the tax form number such as 1040 or 1065, and check the appropriate box for the type of transcript requested.

- Complete the signature section by signing and dating the form. Ensure that you check the box confirming authorization to sign.

- After filling out all applicable lines, save your changes. You then have the option to download, print, or share the completed form.

Start filling out your documents online now for a more efficient process.

The SBA loan subsidy is not taxable income to the borrower and need not be reported on your tax return as such. Further, the deductible expenses paid by the subsidy are tax deductible, such as interest and fees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.