Loading

Get Lst Exemption Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lst Exemption Form online

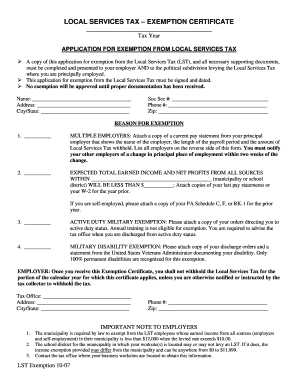

Completing the Lst Exemption Form online is a straightforward process that requires careful attention to detail. This guide will walk you through each section of the form, ensuring you understand the requirements and can submit your application efficiently.

Follow the steps to complete your Lst Exemption Form online

- Press the ‘Get Form’ button to access the Lst Exemption Form, which will open for you to fill out online.

- Begin by entering your basic information in the designated fields, including your name, address, city/state, social security number, phone number, and zip code.

- In the 'Reason for Exemption' section, clearly indicate your reason for seeking an exemption from the Local Services Tax. Make sure to select one of the categories listed (e.g., multiple employers, self-employment income, military service) and provide necessary details.

- If applicable, attach relevant documentation, such as a current pay statement or copies of your last W-2 forms, to support your exemption claim.

- List all places of employment in the Employment Information section. Start with your primary employer and follow with any secondary employers. Provide details such as the employer's name, address, municipality, and your employment status.

- Review all information carefully to ensure it is accurate and complete. This is crucial because the application will not be approved until all necessary documentation is received.

- Once you have filled out the form completely, you can save changes, download a copy of the form, print it, or share it as needed.

Complete your Lst Exemption Form online today to ensure you receive your appropriate tax exemption.

You cannot deduct federal income tax. You can deduct Social Security, Medicare and federal unemployment taxes (FUTA) you paid out of your own funds as an employer. You can also deduct payments you made as an employer to a state unemployment compensation fund or to a state disability benefit fund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.