Loading

Get Oromia Revenue Authority Declaration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Oromia Revenue Authority Declaration Form online

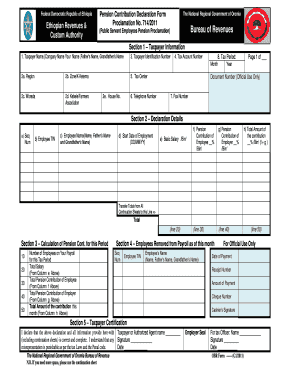

The Oromia Revenue Authority Declaration Form is a vital document for public servant employees in Ethiopia, specifically for the purpose of declaring pension contributions. This guide will provide you with clear instructions on how to complete this form online, ensuring that all necessary information is accurately submitted.

Follow the steps to fill out the form correctly online:

- Press the ‘Get Form’ button to obtain the declaration form and open it in the designated editing area.

- In Section 1, enter your taxpayer information. This includes your full name, taxpayer identification number, tax account number, and contact details such as telephone and fax numbers.

- Specify your tax period by filling in the month and year for which you are declaring pension contributions.

- Provide your address details, including the region, zone or K-Ketema, woreda, kebele or farmers association, and house number.

- Proceed to Section 2 to fill in the declaration details for your employees. Enter the sequence number, employee TIN, full names of employees (including father’s and grandfather’s names), start date of employment, basic salary, and the respective pension contributions of both the employee and employer.

- Calculate the total amount of the pension contribution for each employee by adding the contributions from both the employee and employer sections.

- In Section 3, you will report the overall calculations for the pension contributions during the tax period. Ensure to list the total number of employees, total salary, and total contributions.

- If there are any employees removed from the payroll within the tax month, fill in Section 4 with their details, including TIN and names.

- Complete Section 5, ensuring you certify the accuracy of all provided information. Include your name, signature, and date. If required, use continuation sheets for additional information.

- Once all sections are filled out, review your entries for accuracy, save changes, and proceed to either download, print, or share the completed form as needed.

Begin completing your Oromia Revenue Authority Declaration Form online today!

Ethiopia has amended its Excise Tax Proclamation no. 1186, published in 2020, with a 2023 edition. The changes were effective on 27 April 2023, the date of ratification. The amendment provides new tax rates for excisable goods and reduce the number of goods exempt from excise tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.