Get Ca Dg-31b 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DG-31B online

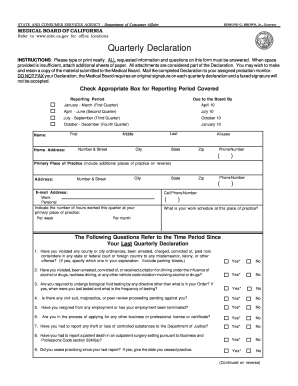

The CA DG-31B form is a Quarterly Declaration required by the Medical Board of California for individuals on probation. This guide provides detailed, step-by-step instructions on how to accurately complete the form online, ensuring all necessary information is included.

Follow the steps to successfully fill out and submit the CA DG-31B form.

- Click ‘Get Form’ button to access the CA DG-31B and open it in your preferred editor.

- Select the appropriate reporting period covered by your declaration from the options provided on the form. Ensure you check the box corresponding to your reporting quarter.

- Enter your personal information, including your name, home address, phone number, and email address in the designated fields.

- Detail your primary place of practice by providing the address and your work schedule, including hours worked per week and per month.

- Answer the questions regarding any violations, arrests, or other legal matters. If applicable, specify details on attached sheets of paper.

- List any other locations where you practice and provide the contact information of the Medical Director or Chief of Staff.

- Include information about any continuing education courses completed within the quarter, and attach relevant certificates if necessary.

- Conclude by signing and dating the form. Make sure to print your name where required and check that all information is complete and accurate.

- Review your filled form, save changes, and download the document. You may then print or share the completed form as needed.

Complete your CA DG-31B form online today to ensure timely submission and compliance with the Medical Board's requirements.

A California fiduciary income tax return must be filed by fiduciaries of estates and irrevocable trusts generating income above a specified amount during the tax year. This requirement ensures that any taxable income is reported to the state. Meeting these obligations is essential to maintaining compliance with California tax laws. To better understand these requirements, explore the helpful resources at CA DG-31B.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.