Loading

Get Canada T183 E 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T183 E online

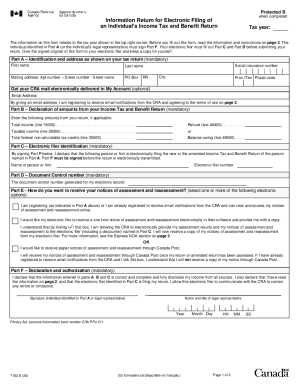

The Canada T183 E form is essential for electronic filing of an individual's income tax and benefit return. This guide will provide a clear and comprehensive overview of each section of the form, helping you navigate the process smoothly and efficiently.

Follow the steps to fill out the Canada T183 E online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part A, provide your identification details. Include your first name, last name, mailing address (including apartment number, street number, street name, and postal code), and your social insurance number. Ensure all information matches what is shown on your tax return.

- Move to Part B. Here, enter the required amounts from your income tax and benefit return, such as total income, refund amount, taxable income, or total federal non-refundable tax credits.

- Proceed to Part C. Provide the electronic filer’s identification by entering their electronic filer number and the name of the person or firm that is electronically filing your return.

- In Part D, note the document control number generated for your electronic record. This is crucial for tracking your submission.

- Part E requires you to select how you would like to receive your notices of assessment and reassessment. You may choose either electronic delivery or paper notices through Canada Post, depending on your preference.

- Finally, complete Part F by declaring that all information provided is accurate. The individual named in Part A or their legal representative must sign to authorize the submission of the form.

- Once all sections are filled out accurately, you can save changes, download the form, print it, or share it as needed.

Complete your documents online today to ensure a smooth filing process.

Now that physical signature is no longer needed. To keep Canadians safe, Revenue Canada now accepts electronic signatures as meeting the signature requirements of the Income Tax Act when using the T183 or T183CORP form, at least temporarily.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.