Loading

Get Irs Form 702

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 702 online

This guide provides clear, step-by-step instructions to help you successfully complete the Irs Form 702 online. Whether you are familiar with digital documents or are new to the process, this comprehensive approach will support you through each section.

Follow the steps to complete the form accurately online.

- Click ‘Get Form’ button to access the form and open it in the editor.

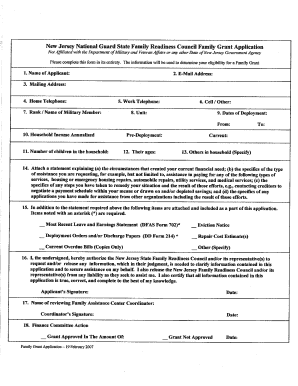

- Carefully review the form layout. The Irs Form 702 consists of several sections, including taxpayer information, entity details, and additional compliance questions. Understand where to input your specific information.

- Begin with the taxpayer information section. This typically requires your name, address, and the taxpayer identification number. Ensure all details are accurate to prevent processing delays.

- Continue to the entity details section. If you are filing on behalf of a partnership or corporation, include the name of the entity and the specific identification number associated with it.

- Fill out any supplemental information as required. This may include details on certain transactions or additional disclosures depending on your situation.

- Review your completed entries in the form. Ensure there are no mistakes or missing information, as accuracy is crucial for successful filing.

- Once you have verified all information is correct, you can save your changes, download the form for your records, print a copy for submission, or share it as needed.

Start filling out your Irs Form 702 online today!

If you own a business that deals in goods and services subject to excise tax, you must prepare a Form 720 quarterly to report the tax to the IRS. The federal government charges an excise tax on specific types of products and services, and in some ways resembles a state sales tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.