Loading

Get Ppp Promissory Note

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ppp Promissory Note online

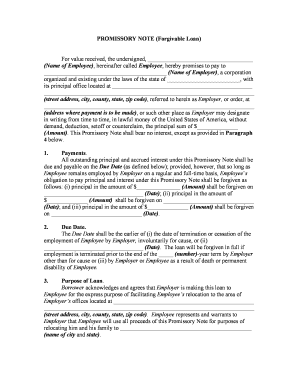

Filling out the Ppp Promissory Note can seem daunting, but this guide will walk you through each section to ensure a clear and accurate completion. Understanding this document is crucial for establishing the terms of the forgivable loan between the employee and employer.

Follow the steps to successfully complete the Ppp Promissory Note online.

- Press the ‘Get Form’ button to obtain the form and open it in your online editor.

- In the first section, you will need to enter the name of the employee where it states ‘Name of Employee’. Ensure this is the correct legal name as it will be recognized in the agreement.

- Next, input the name of the employer in the space labeled ‘Name of Employer’. Be sure to use the official name of the organization.

- Fill in the state of incorporation for the employer in the section provided. This identifies the jurisdiction under which the employer operates.

- Complete the employer's address by providing the street address, city, county, state, and zip code. This is where any correspondence will be directed.

- In the payment section, specify the principal sum of the loan in the designated line for ‘Amount’. This must be a monetary figure and should be accurate.

- Detail the forgiveness schedule by specifying the amounts and dates corresponding to each portion of the loan that will be forgiven. Fill in these amounts carefully.

- Indicate the ‘Due Date’ in the relevant section. This can be based on employment termination or a specified date, ensuring it is clear and agreed upon.

- For the purpose of the loan, describe the intended relocation in the specified area, including the name of the city and state.

- Review any default clauses. Acknowledge your understanding of the terms regarding late payments and possible penalties.

- Finally, in the signing section, ensure the employee completes their name and the date of execution, marking the official agreement.

- Once all fields are filled out accurately, you can save changes, download a copy for your records, print the document, or share it electronically if needed.

Complete your Ppp Promissory Note online today to streamline your paperwork.

Lenders have up to 20 days after the date the SBA approves your application to fund your PPP loan. In most cases, this funding happens within 2 to 3 business days after you sign your promissory note. To avoid delays, check your application Status Detail to ensure your bank info is complete.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.