Loading

Get 09 03 Request For Withdrawal From Drop Ibo Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 09 03 Request For Withdrawal From Drop Ibo Form online

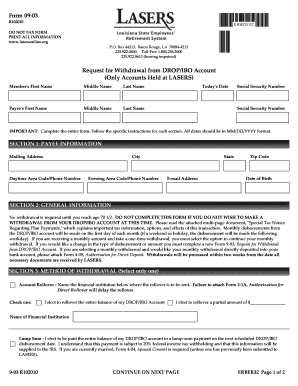

The 09 03 Request For Withdrawal From Drop Ibo Form is essential for members wishing to withdraw funds from their DROP/IBO accounts held at LASERS. Filling out this form accurately is crucial to ensure a smooth transaction. This guide provides step-by-step instructions for completing the form online, making the process more accessible for all users.

Follow the steps to complete the withdrawal request form online.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

- In the first section, enter the payee information. Fill in the first name, middle name, last name, social security number, and today's date. Also, include your mailing address, city, state, zip code, daytime and evening phone numbers, email address, and date of birth.

- Proceed to the general information section. Carefully read the instructions and the special tax notice regarding plan payments provided in the accompanying documents. Ensure you understand the withdrawal types and options available.

- For the method of withdrawal section, select only one option: account rollover, lump sum payment, or one-time withdrawal. If selecting account rollover, specify the financial institution and attach the necessary Form 2-1A to avoid delays. For a one-time withdrawal, indicate the amount and understand the tax implications. If continuing with monthly withdrawals, indicate the amount you wish to receive each month.

- Sign the form in the member signature section to confirm your chosen method of withdrawal. Ensure the date is accurate.

- Review the completed form for accuracy and completeness. Once satisfied, you can save your changes, download, print, or share the form as needed.

Complete your request for withdrawal from DROP IBO accounts online by following these instructions carefully.

An IRA transfer can be made directly to another account, and IRA transfers can also involve the liquidation of funds for depositing capital in a new account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.