Get Illinois Rut 50 Printable Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois Rut 50 printable forms online

This guide provides clear and detailed instructions on how to complete the Illinois Rut 50 printable forms online. Whether you are familiar with online forms or new to the process, you will find helpful tips and steps to successfully fill out this form.

Follow the steps to complete the Illinois Rut 50 printable forms online

- Press the ‘Get Form’ button to access the Illinois Rut 50 printable forms and open it in your preferred editor.

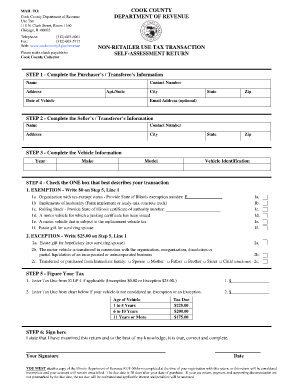

- Begin with Step 1: Complete the Purchaser’s / Transferee’s Information. Fill in your name, contact number, address (including apartment or suite number, city, state, and zip), and the date of vehicle purchase. Optionally, you may provide your email address.

- Move to Step 2: Complete the Seller’s / Transferor’s Information. Fill in the seller's name, contact number, address, and city.

- Proceed to Step 3: Complete the Vehicle Information. Enter the year, make, model, and vehicle identification number.

- In Step 4, check the ONE box that describes your transaction. Follow the instructions for exemptions or exceptions, and fill in the necessary details as specified.

- Next, proceed to Step 5: Figure Your Tax. Enter the applicable tax due based on your selection in Step 4. Be sure to follow the pricing criteria based on the age of the vehicle.

- Lastly, in Step 6, sign and date the form where indicated, confirming the accuracy of the information provided.

- After completing the form, ensure to save your changes. You can download, print, or share the form as needed.

To ensure compliance and avoid penalties, complete your Illinois Rut 50 printable forms online today.

Form RUT-50 must be filed by a person or business titling a motor vehicle in Illinois when the person or business: ... moved into Illinois with a motor vehicle he or she owns that was originally purchased or acquired by gift or transfer from a private party.

Fill Illinois Rut 50 Printable Forms

RUT-50, Instructions for Private Party Vehicle Use Tax Transaction Return. Illinois Department of Revenue. RUT-6 Form RUT-50 Reference Guide. If purchased from an individual, you must complete Tax Form RUT-50. Fill out the illinois tax rut 50 chart PDF form for FREE! Motor vehicles that must be reported on Form RUT-50 include cars, trucks, vans, motorcycles, motor homes, ATVs, and buses. The Electronic Registration and Title (ERT) System allows you to complete and print an Application for Vehicle Transaction(s) (VSD 190). Your county tax amount must be entered on Form RUT-50, Step 6, Line 3.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.