Loading

Get Ks K-cns 100 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS K-CNS 100 online

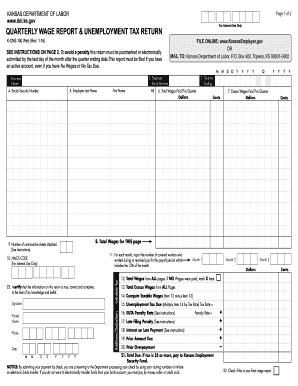

Filling out the KS K-CNS 100 form is essential for businesses in Kansas to report their quarterly wages and unemployment tax due. This guide provides clear and user-friendly instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the KS K-CNS 100 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your business name in the designated field, ensuring it is the same as listed in your official documents.

- Enter your six-digit unemployment tax number accurately in the appropriate section.

- Indicate the quarter ending date in the format MM/DD/YYYY, along with the corresponding quarter number.

- List the Social Security number for each employee in the relevant fields.

- Fill in the names of your employees: last name, first name, and middle initial in the required sections.

- Report the total wages paid to each employee during the quarter in the specified field. Ensure you record wages for the quarter they are received.

- If there are wages exceeding the $14,000 taxable wage base paid to an employee, report these excess wages in the appropriate section.

- Complete the calculation for total wages and excess wages for the page as directed, summing totals for the current page.

- Provide the number of continuation sheets attached, if any, to account for additional employees.

- Calculate the total taxable wages as instructed, and ensure you multiply by your designated tax rate to find the unemployment tax due.

- Input any penalties or interest on late payments if applicable, following the instructions carefully.

- Sign the form in the designated signature section and include your printed name and phone number.

- Review all entered information for accuracy before proceeding to submit the form.

- Once satisfied, you can save the changes, download the completed form, print it for your records, or share it as needed.

Complete your KS K-CNS 100 form online today for timely filing.

In Kansas, the unemployment tax rate varies depending on a variety of factors, including the employer's experience rating. The KS K-CNS 100 system provides essential information about current rates and how they are determined. Employers should stay informed as these rates can change each year. For more comprehensive details and assistance, consider the tools available on the uslegalforms platform.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.