Loading

Get Quiz Of Instalment Sales Method

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Quiz Of Instalment Sales Method online

Filling out the Quiz Of Instalment Sales Method online is a straightforward process designed to help you secure a manufactured home through installment sales. This guide provides you with clear, step-by-step instructions to ensure accuracy and compliance when completing the form.

Follow the steps to successfully complete the Quiz Of Instalment Sales Method online.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

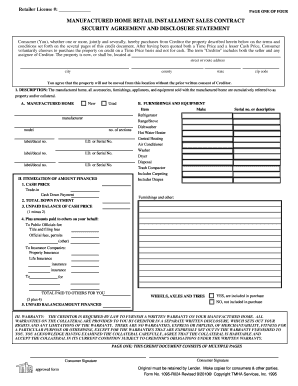

- Begin by filling out the Retail License number required at the top of the document. Ensure that the license number is entered accurately to avoid any processing delays.

- In the Consumer section, list your name or the names of all people purchasing the manufactured home. This should reflect how the ownership will be titled.

- Fill in the property details, including the street address, city, county, state, and zip code where the manufactured home will be located.

- Under the Description section, indicate whether the manufactured home is new or used and provide the manufacturer's details, including the model, number of sections, and identification numbers.

- In the Itemization of Amount Financed section, clearly itemize the cash price of the manufactured home, any trade-in value, and the down payment to calculate the total amount financed accurately.

- Proceed to disclose any additional furnishings and equipment sold with the manufactured home by listing their specifics, such as make and serial numbers.

- Complete the Warranty and Insurance sections by acknowledging the warranty provided and selecting the required insurance coverage options.

- Pay special attention to the Payment section, documenting the finance charge, annual percentage rate, and the number of monthly payments required.

- At the conclusion of the form, ensure both consumers sign in the designated areas. Double-check all filled-out information for accuracy.

- Finally, save your changes, and you may choose to download, print, or share the completed form as necessary.

Begin filling out your Quiz Of Instalment Sales Method online today to take the next step towards your new home!

An example of this would be a car, house, or any purchase that is done on credit. Installment sales are common in real estate but are restricted to individual sellers and buyers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.