Loading

Get In Form Wh-4 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form WH-4 online

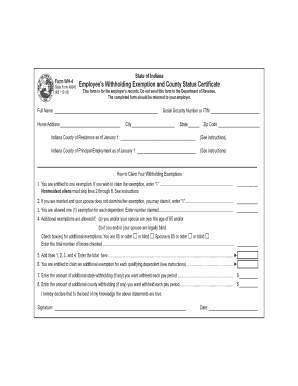

The IN Form WH-4 is essential for employees in Indiana to determine their withholding exemptions for state and county income tax. This guide will walk you through each section of the form, ensuring you complete it accurately and efficiently online.

Follow the steps to complete your IN Form WH-4 online

- Click ‘Get Form’ button to access the form and open it in the editor.

- Enter your full name, Social Security number or ITIN, and home address accurately.

- Provide your Indiana county of residence as of January 1 and your county of principal employment as of the same date.

- Claim your withholding exemptions if eligible. For each exemption you're entitled to, follow these prompts: enter '1' if you're claiming yourself, additional '1' if your spouse does not claim their exemption.

- Count and enter the number of exemptions for dependents you qualify for. Remember that you can claim an exemption for dependents who meet specific criteria.

- Indicate any additional exemptions if you or your spouse are over the age of 65 or legally blind by checking the appropriate boxes.

- Add the total number of exemptions from lines 1, 2, 3, and 4, and enter the total in the designated box.

- Determine if you want to claim an additional exemption for qualifying dependents and indicate this on the form as needed.

- Decide the amount of additional state withholding you want deducted from your pay period; enter this in the specified field.

- Similarly, specify the amount of additional county withholding, if any, that you wish to have deducted from your pay.

- Sign and date the form, confirming the accuracy of your provided information before submission.

- After completing the form, save your changes, download, print, or share the completed form as necessary, and return it to your employer.

Start completing your IN Form WH-4 online now to ensure accurate withholding exemptions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file Indiana withholding tax, you'll first need to determine the taxes withheld using the IN Form WH-4. Once you have calculated your withholding amounts, you can file the taxes along with your employer's state tax return. Visit the Indiana Department of Revenue website for detailed information and forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.