Loading

Get In Form Wh-4 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form WH-4 online

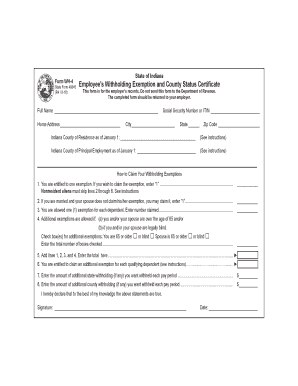

The IN Form WH-4 is an important document used for claiming withholding exemptions for employees in Indiana. This guide will help you understand how to fill out this form online in a clear and straightforward manner.

Follow the steps to complete your IN Form WH-4 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your full name, Social Security number or ITIN, and home address in the designated fields.

- Next, indicate your Indiana county of residence and your county of principal employment as of January 1.

- To claim your withholding exemptions, enter '1' if you are entitled to one exemption. If you are a nonresident alien, enter '1' on line 1, then proceed to line 7.

- If you are married and your spouse does not claim their own exemption, enter '1' for that exemption.

- For each dependent you are claiming, enter the corresponding number on line 3.

- You may also check boxes if you and/or your spouse are over the age of 65 or legally blind to claim additional exemptions.

- Add lines 1, 2, 3, and 4, and enter the total in the provided box.

- If you are eligible for additional exemptions for qualifying dependents, enter that information in the specified area.

- Specify any additional amount you wish to be withheld from your wages each pay period on lines 7 and 8.

- Finally, sign and date the form to declare that the information provided is accurate.

- Once completed, save your changes, and download, print, or share the form as needed.

Complete your documents online today to ensure your withholding exemptions are accurately recorded.

If you receive pension payments and want to manage federal tax withholding, then filling out the W-4P form is essential. The IN Form WH-4 aids in detailing your expected income tax withholdings. This step ensures you are prepared when tax season arrives, and it can help prevent any surprises.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.