Loading

Get Gst Form 44

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst Form 44 online

Filling out the Gst Form 44 online can be a straightforward process with the right guidance. This guide will provide step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the Gst Form 44 online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

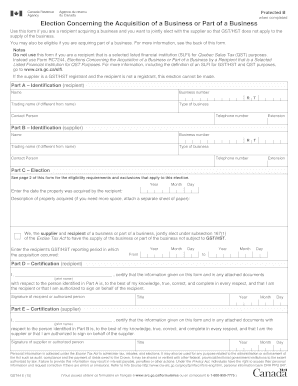

- In Part A, provide identification details for the recipient, including their name, business number, trading name if different, type of business, contact person, telephone number, and extension.

- In Part B, enter the supplier's identification information. This includes their name, business number, trading name, type of business, contact person, telephone number, and extension.

- Complete Part C by entering the date the property was acquired by the recipient and providing a description of the property acquired. If additional space is needed, attach a separate sheet.

- In Part C, both the supplier and recipient must jointly elect to have the supply of the business not subject to GST/HST. Fill in the recipient's GST/HST reporting period during which the acquisition occurred.

- In Part D, the recipient must certify the accuracy of the provided information by signing and dating the certification.

- In Part E, the supplier must provide their certification by signing and dating as well.

- Once completed, save your changes to the form. You can then download, print, or share the form as needed.

Complete your Gst Form 44 online today to ensure compliance and proper filing.

Right-click on the form link and select "Save Target As" or "Save Link As", and save the form to your computer. Launch Adobe Reader. Open the PDF from within Adobe Reader. You can now fill and save your form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.