Loading

Get Employer Acknowledgement Form (eaf)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EMPLOYER ACKNOWLEDGEMENT FORM (EAF) online

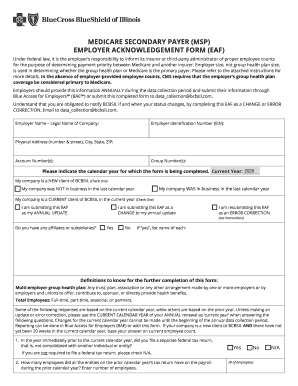

Completing the Employer Acknowledgement Form (EAF) is a crucial task for employers to ensure accurate Medicare payment priorities. This guide provides a step-by-step approach to effectively fill out the EAF online, helping you navigate each section with clarity.

Follow the steps to successfully complete your EAF online

- Click the ‘Get Form’ button to access the EAF and open it in your chosen editor.

- Begin by entering your employer's legal name and Employer Identification Number (EIN) in the designated fields.

- Provide the physical address, including the street number, city, state, and ZIP code.

- Fill in any account numbers and group numbers if applicable to your business.

- Indicate the calendar year for which you are completing the form, ensuring it reflects the current year (e.g., 2020).

- Select the appropriate checkbox indicating your company’s status as a new client or if it was in business last calendar year.

- Choose among the options indicating if you are submitting the EAF as an original submission, change, or error correction.

- Indicate whether your company has any affiliates or subsidiaries by selecting 'Yes' or 'No.' If yes, list the names of each.

- Respond to questions regarding federal tax returns and employee counts based on past and current calendar years.

- Review the answers provided for accuracy, particularly focusing on employee counts and multi-employer group health plan status.

- Affirm the completeness and accuracy of the information by adding the signature of an authorized representative, printing their name, title, and date.

- Once all fields are completed, you can save changes, download the form, print it for records, or share it with the relevant parties.

Ensure your employer information is accurately documented by completing the EAF online today.

Medicare is the secondary payer of benefits if the employer employs 20 or more employees. Both full- time and part-time employees are counted toward the 20-employee threshold.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.