Loading

Get Form Bb-1, Rev 2019, State Of Hawaii Basic Business Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form BB-1, Rev 2019, State of Hawaii Basic Business Application online

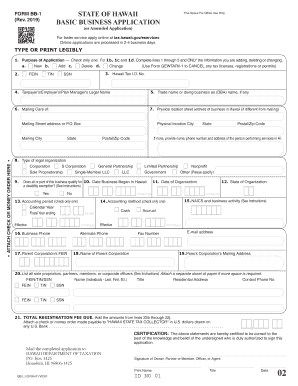

This guide provides comprehensive and clear instructions on completing the Form BB-1, Rev 2019, State of Hawaii Basic Business Application. This online form is essential for registering various tax licenses and permits in Hawaii, ensuring a smooth process for new and existing businesses.

Follow the steps to complete the application confidently.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Identify the purpose of your application by checking one box in section 1 (New, Add, Delete, or Change). If you choose to add, delete, or change, ensure you complete lines 1 through 5 with the relevant information.

- In section 2, enter your Federal Employer Identification Number (FEIN), Tax Identification Number (TIN), or Social Security Number (SSN) as required.

- In line 3, enter your Hawaii Tax Identification Number if applicable. Leave blank for new applications.

- Provide the legal name of the taxpayer, employer, or plan manager in line 4, ensuring it matches official documents.

- If you have a trade name, enter it in line 5 as your Doing Business As (DBA) name.

- In line 6, complete the mailing address, and ensure to cross-reference it with any address changes. If this is your first application, this section will be essential for correspondence.

- For line 7, input the physical location of your business in Hawaii. If this is the same as your mailing address, leave it blank.

- Select the type of legal organization in line 8, checking one of the available options.

- Respond to the disability exemption question in line 9 by checking ‘Yes’ or ‘No’ based on your eligibility.

- Fill in lines 10 to 13 with the relevant dates: when your business began in Hawaii and the date of your organization.

- Choose your accounting period in line 14 and indicate your accounting method (cash or accrual) in line 15.

- Provide your primary business activity and NAICS code in line 15.

- In line 20, list relevant individuals such as sole proprietors, partners, or members and include their contact details. If more space is required, attach a separate sheet.

- Add up all applicable fees in line 21, ensuring you attach a check or money order payable to 'Hawaii State Tax Collector.'

- Select the necessary tax types and provide any additional documentation required prior to submission. Ensure all selected boxes reflect your current business operations.

- Once all sections are completed, review the form for accuracy, then save your changes, download, print, or share as needed.

Start filling out your Form BB-1 online today to ensure timely registration for your business!

During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.