Loading

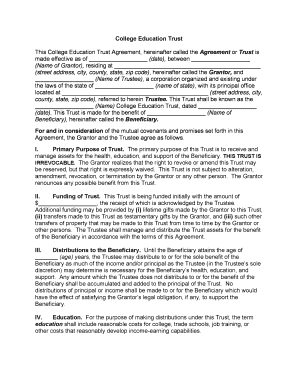

Get Education Trust

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Education Trust online

Filling out an Education Trust can be an essential step in securing financial support for a beneficiary's education and well-being. This guide provides clear and supportive instructions to help users through the process of completing the Education Trust online, ensuring all necessary components are properly addressed.

Follow the steps to complete the Education Trust form effectively.

- Press the ‘Get Form’ button to access the Education Trust document and open it in the online editor.

- Fill in the date when the Agreement becomes effective. This should be the date you are completing the form.

- Enter the name of the Grantor, which refers to the individual initiating the Trust. Include their full name and residential address.

- Specify the name of the Trustee, which is usually a legal entity or corporation responsible for managing the Trust. Include the corporation’s name and address.

- Provide the name of the Trust, ensuring it reflects the purpose of the Agreement, and enter the corresponding date.

- Identify the Beneficiary, who will benefit from the Trust. Enter the full name of the Beneficiary.

- In the 'Primary Purpose of Trust' section, acknowledge that the Education Trust is irrevocable and ensure you understand the implications of this clause.

- Document the initial funding amount of the Trust and record any future funding mechanisms available to the Grantor.

- Specify the age at which the Beneficiary can receive distributions from the Trust and detail any other terms surrounding distributions as needed.

- Once all sections are filled in accurately, review the document for any necessary corrections.

- Save the changes, and choose to download, print, or share the completed Education Trust document to finalize the process.

Complete your Education Trust form online to provide financial support for educational needs.

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust, but not on returned principal. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.