Get Canada T661 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T661 online

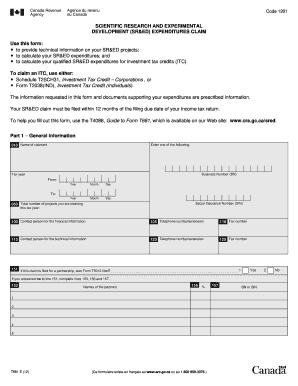

The Canada T661 form is essential for claiming scientific research and experimental development (SR&ED) expenditures. This guide provides you with clear, step-by-step instructions to help you accurately complete the form online, ensuring you meet all necessary requirements.

Follow the steps to successfully complete the Canada T661 form online.

- Press the ‘Get Form’ button to obtain the Canada T661 form and open it in your preferred online document software.

- Fill out Part 1, providing general information. Include your Business Number (BN) or Social Insurance Number (SIN), tax year ranges, total number of projects, and contact details for financial and technical information.

- Complete Part 2 for each project. Include project identification such as title, start date, and expected completion date. Indicate whether the project work was completed independently or collaboratively with other organizations.

- In Section A of Part 2, indicate the field of science or technology, and describe the purpose of the work. Choose the section based on whether the work relates to experimental development or basic/applying research.

- Detail any technological advancements or knowledge aimed for in sections B and C of Part 2. Include descriptions of obstacles overcome and the systematic investigations conducted.

- Complete Part 3 to calculate your SR&ED expenditures. Select your method for calculating expenditures and provide detailed financial information on salaries, materials, contracts, and overheads related to your SR&ED projects.

- If using the proxy method, fill out Part 5 to calculate the prescribed proxy amount and include this in Part 4.

- In Part 4, record the total expenditures and split them into current and capital expenditures for investment tax credit (ITC) purposes.

- Review all provided information for accuracy and completeness. Make sure to have supporting documentation ready for potential reviews.

- Save your changes, and once you are satisfied with the form, download, print, or share it as needed.

Start filling out your Canada T661 form online today to ensure you meet all claim requirements.

Get form

Filling out a W-8BEN form in Canada involves providing your identification information, such as your name and address, while also declaring your foreign status. This form helps you claim reduced withholding rates on certain types of income, including dividends and royalties. Ensure that the information aligns with your tax records and the Canada T661, if applicable, as it impacts your tax treatment in the US. Resources on uslegalforms can assist in navigating this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.