Loading

Get Form 13 Cce Nebraska

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 13 Cce Nebraska online

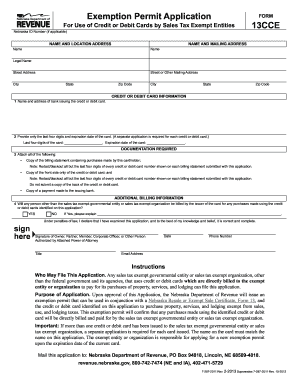

Filling out the Form 13 Cce Nebraska online can streamline the process of applying for a credit or debit card exemption permit for sales tax exempt entities. This guide provides detailed instructions to help users navigate the form accurately and effectively.

Follow the steps to complete the Form 13 Cce Nebraska online.

- Click the ‘Get Form’ button to obtain the digital version of the Form 13 Cce Nebraska and open it in your preferred editor.

- Begin by entering your Nebraska ID number if applicable. This will help identify your account with the Nebraska Department of Revenue.

- Fill in your legal name and location address. Ensure that the name matches the one on the credit or debit card.

- Provide the name and address of the bank that issues your credit or debit card.

- In the credit or debit card information section, fill in the last four digits of the card and its expiration date. Remember that a separate application is needed for each card.

- Gather the required documentation as listed in the form. This includes: - A copy of the billing statement with redacted details, showing purchases made by the cardholder. - A copy of the front side of the credit or debit card, ensuring you only show the last four digits. - A copy of any payment made to the issuing bank.

- Respond to the additional billing information question, indicating whether any person other than the exempt entity will be billed for purchases.

- Sign and date the application, ensuring the signature is from an authorized individual, such as an owner or corporate officer.

- Once all sections are completed, save your changes. You can then download, print, or share the completed form as needed.

Take action now to complete your Form 13 Cce Nebraska online.

Issuing a resale certificate allows you to buy items you will sell in your business operations without paying amounts for tax to your suppliers. Generally, if you make three or more sales in a 12-month period, you are required to hold a seller's permit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.