Get Canada T1013 E 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1013 E online

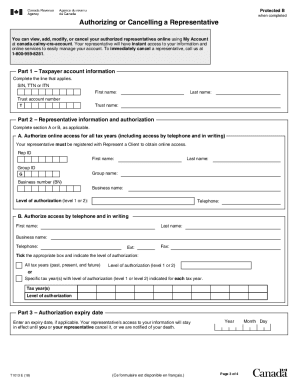

The Canada T1013 E form is essential for individuals or trusts wishing to authorize a representative to handle their income tax matters with the Canada Revenue Agency. Completing this form correctly ensures that your representative has the access they need to assist you effectively.

Follow the steps to complete the Canada T1013 E form online.

- Press the ‘Get Form’ button to acquire the Canada T1013 E form and launch it in your editing interface.

- In Part 1, provide your taxpayer account information. This includes entering your Social Insurance Number (SIN), Temporary Tax Number (TTN), or Individual Tax Number (ITN) along with your name.

- Proceed to Part 2 and select either Section A or Section B based on your needs. If you opt for Section A, you will authorize online access for all tax years. Ensure your representative is registered with Represent a Client.

- In Section A, fill in your representative's details, including their name and authorization level, either Level 1 or Level 2, based on the access required.

- If you choose Section B, fill in your representative's information and select their authorization level. This section allows access only via telephone and in writing.

- In Part 3, indicate an expiry date for the authorization if you would like it to terminate at a specific time.

- If you need to cancel a representative, move to Part 4. Indicate whether you wish to cancel all representatives or just a specific one, and provide the necessary details.

- Complete Part 5 by signing and dating the form. Ensure you or your legal representative signs it; without this, the form will not be accepted.

- Finally, send your completed form to the appropriate CRA tax centre as detailed on the form. Make sure to keep a copy for your records.

Start filing your Canada T1013 E form online now to ensure your representative has the access they need.

Filling out a declaration form in the Canada airport requires you to detail all items you are declaring. This includes goods purchased abroad and any items that may be subject to duty. Be transparent about your declarations to avoid penalties. For help with this process, US Legal Forms offers templates tailored to customs requirements including those linked with Canada T1013 E.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.