Loading

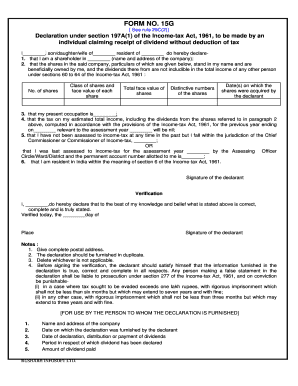

Get 15g See Rule 29c(2) Declaration Under Section 197a(1) Of The Income-tax Act, 1961, To Be Made By An

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 15G See Rule 29C(2) Declaration Under Section 197A(1) Of The Income-tax Act, 1961, To Be Made By An online

Filling out the 15G See Rule 29C(2) Declaration is essential for individuals wishing to claim dividend receipts without taxation. This guide provides a comprehensive step-by-step approach to help you navigate the form effectively and ensure accurate completion.

Follow the steps to complete the declaration form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by filling out your name in the first blank as the declarant, specifying if you are the son, daughter, or partner of someone.

- In the next blank, indicate your residential address to confirm your residence status.

- In the following section, declare your status as a shareholder by entering the name of the company and its address.

- Next, provide the particulars of your shares, including the number of shares you own, the class and face value of each share, the total face value, distinctive numbers of the shares, and the acquisition date(s).

- State your current occupation in the designated field.

- Estimate your total income, including dividends from shares, and confirm if it is nil for the previous financial year relevant to the assessment year specified.

- Indicate whether you have ever been assessed to income tax and provide details accordingly, or mention your last assessment year and the associated assessing officer's details.

- Confirm your residency in India as per section 6 of the Income-tax Act, 1961.

- Sign the declarative statement section to confirm the accuracy of the provided information.

- In the verification section, fill in your name, verify the date of verification, and provide the place. Repeat your signature.

- Finally, ensure to review the form for accuracy, then proceed to save the changes, download, print, or share the completed form.

Complete your 15G declaration online now to ensure you benefit from tax exemptions on dividends.

TDS is deducted @ 10% on EPF balance if withdrawn before 5 years of service. Remember to mention your PAN at the time of withdrawal. If PAN is not provided TDS shall be deducted at highest slab rate of 30%. You can submit Form 15G/Form15H if tax on your total income including EPF withdrawal is nil.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.