Get Formulaire 164 R - Administration Des Contributions Directes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulaire 164 R - Administration Des Contributions Directes online

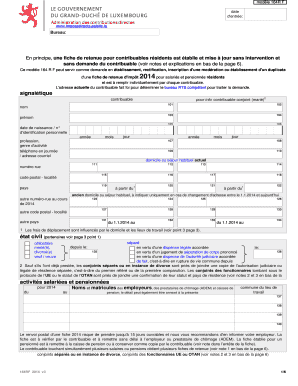

This guide provides thorough instructions on completing the Formulaire 164 R - Administration Des Contributions Directes, which is essential for tax declaration purposes. By following these steps, users will gain clarity on how to accurately fill out each section of the form online.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with section 101, where you will provide your first name and surname as a taxpayer.

- In section 102, enter your date of birth and personal identification number.

- Complete section 103 by specifying your profession and type of activity.

- Provide your telephone number for daytime contact and email address in section 104.

- In sections 106 to 119, fill out your current home address, including street number, postal code, locality, and country.

- If you have changed your address since January 1, 2014, provide details in sections 120 to 129.

- Details of marital status can be entered in section 135, where you will specify your current civil status.

- For section 137 onwards, list the names and details of your employers and pension providers as necessary.

- In the children section, report on each child under section 201, including their identification number and birthdate.

- When applicable, report extraordinary expenses in the designated fields and provide documentation where requested.

- Finally, review the entire form for accuracy before saving your changes. You can then download, print, or share the form as needed.

Prepare and file your Formulaire 164 R online to ensure compliance and avoid penalties.

Si vous ne disposez pas d'imprimante, vous pouvez demander ces formulaires papiers à votre Service des impôts des particuliers. Après l'avoir remplie, vous devrez déposer ou envoyer votre déclaration « papier », vous devez la renvoyer à ce service.

Fill Formulaire 164 R - Administration Des Contributions Directes

Formulaire de déclaration d'impôt année 2024 – modèle 100F. Le formulaire est disponible sur le site de l'Administration des contributions directes, rubrique Formulaires ‣ Décompte annuel. (RTS). Elle est adressée au bénéficiaire par courrier postal dans un délai moyen de 30 jours.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.