Loading

Get Va Form 26-1817 - Military.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form 26-1817 - Military.com online

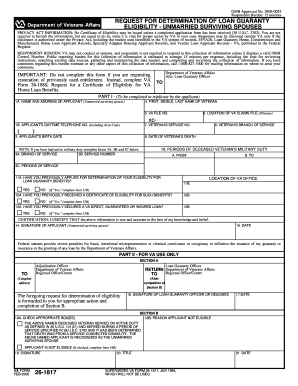

VA Form 26-1817 is crucial for unmarried surviving spouses seeking to determine their eligibility for loan guaranty benefits. This guide provides clear, step-by-step instructions to help users navigate the form successfully and confidently.

Follow the steps to complete the VA Form 26-1817 online.

- Click ‘Get Form’ button to access the form in the editor.

- Begin with Part I, where you will provide your name and address as the applicant. Ensure to include all necessary information accurately.

- Fill in the name of the veteran in the specified fields, including their first, middle, and last names, along with their VA file number.

- Include the veteran's service number and branch of service, along with the dates relevant to the veteran's service.

- Move to the section regarding previous applications. Indicate whether you have previously applied for a determination of loan guaranty eligibility and provide further details if applicable.

- Next, state if you have ever received a Certificate of Eligibility for benefits. Be thorough in your responses, as this information is essential for processing.

- You will also indicate if you have secured a VA direct, guaranteed, or insured loan in the past. Again, provide completeness and accuracy in your answers.

- Certify the accuracy of the information provided by signing and dating the application. This section validates your submission.

- Once you have completed all required sections, make sure to save your changes. You can then download, print, or share the completed form as needed.

Complete your forms online efficiently and with confidence today!

According to the VA official site, the surviving spouse, where applicable, would assume the debt. ... In cases where the borrower dies but has no co-borrower or surviving spouse, the veteran's estate would be responsible for the VA guaranteed mortgage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.