Loading

Get Ri Ri-1040nr - Schedule Ii 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI RI-1040NR - Schedule II online

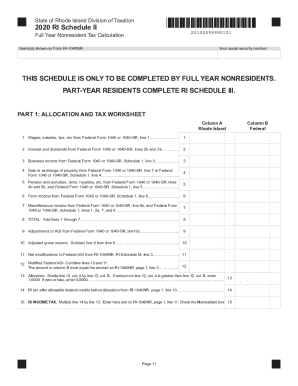

This guide provides a comprehensive overview of how to accurately complete the RI RI-1040NR - Schedule II online. Designed for full-year nonresidents, the form is essential for calculating your Rhode Island tax obligations based on the income you earn.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter your name(s) as shown on Form RI-1040NR and your social security number in the designated fields.

- Proceed to Part 1: Allocation and tax worksheet. Fill out Column A with your income details from Federal Form 1040 or 1040-SR, including wages, salaries, interest, business income, and other types of income in the respective lines.

- After entering your totals, calculate your adjusted gross income in Column B by subtracting adjustments to AGI from the total. This will lead you to calculate your modified Federal AGI.

- In line 13, determine the allocation percentage by dividing your total Rhode Island income by your total adjusted gross income.

- Enter your Rhode Island income tax based on the multiplication of the allowable credits with the allocated tax amount on line 15.

- Navigate to Part 2 if necessary, which details the allocation of wage and salary income, particularly useful for those who worked in multiple states. Complete the required sections detailing your working days.

- If business allocation is essential, move to Part 3, and input your property and income details to determine your business allocation percentage.

- Once all details are completed, remember to save your changes. You can download, print, or share the form as required.

Complete your RI RI-1040NR - Schedule II online to ensure accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Welcome to Free File. You may qualify to prepare and file your federal and Rhode Island resident personal income tax returns online at no charge. ... You may be charged a fee for filing your taxes electronically if you do not meet the qualifications for Free File.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.