Loading

Get Ny Dtf It-209 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-209 online

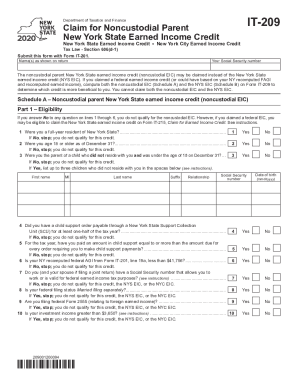

The NY DTF IT-209 is a form used by noncustodial parents in New York to claim the New York State Earned Income Credit. This guide provides a comprehensive overview of the form and its components, offering step-by-step instructions tailored for users with varying levels of experience.

Follow the steps to properly complete and submit the NY DTF IT-209 online.

- Press the ‘Get Form’ button to access the NY DTF IT-209 and open it in the online editor.

- Fill in your name as it appears on your tax return and include your Social Security number in the designated field.

- Review the eligibility criteria in Schedule A. Answer each question based on your situation. If you answer 'No' to any question from lines 1 to 6, you do not qualify for the noncustodial EIC.

- Complete Part 1 of Schedule A by providing details about your child or children, including their names, Social Security numbers, and dates of birth.

- Proceed to Part 2 to indicate whether you have already filed your New York State income tax return. If you have, state your preference regarding calculation of either noncustodial EIC or NYS EIC.

- In Part 3, report your earned income. Enter wages, adjustments, business income or loss, and calculate total earned income as instructed.

- Move to Part 4 for credit computation. Follow the prompts to determine the noncustodial EIC based on your calculations from previous sections.

- If you qualify for the New York State Earned Income Credit, complete Schedule B, addressing questions about federal EIC claims and providing details on qualifying children.

- Finally, review all provided information for accuracy. Once completed, you can save your changes, download the form, print it, or share it as needed.

Complete your documents online to take advantage of available credits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In 2020, income derived from investments disqualifies you if it is greater than $3,650 in one year, including income from stock dividends, rental properties or inheritance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.