Loading

Get Form 8871

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8871 online

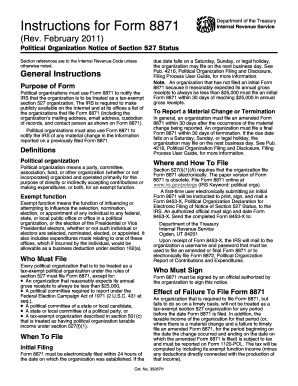

Form 8871 is essential for political organizations aiming to be recognized as tax-exempt under section 527. This guide provides clear, step-by-step instructions for completing the form online, ensuring you follow each necessary component accurately.

Follow the steps to complete Form 8871 smoothly.

- Click 'Get Form' button to access the form and open it in your preferred editing tool.

- Enter the Employer Identification Number (EIN) in the designated field. If you do not have an EIN, you will need to apply for one using Form SS-4.

- If filing an amended notice, provide the date of the material change on line 4b; otherwise, this step can be skipped for initial notices.

- On line 9, enter the name of the election authority and any identification numbers assigned, or enter 'None' if not applicable.

- List all officers, directors, and highly compensated employees on lines 15a through 15c, including names, titles, and addresses.

- After submitting, you can save changes, download, print, or share the form as necessary.

Complete your Form 8871 online today to ensure your political organization meets IRS requirements.

IRC 527 provides that "political organizations" are subject to tax only to the extent provided for in that section. For all other purposes under federal law, they are treated as tax exempt organizations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.