Get Freddie Mac 65a/fannie Mae 1003a 2005-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Freddie Mac 65A/Fannie Mae 1003A online

Filling out the Freddie Mac Form 65A or Fannie Mae Form 1003A online is an essential step in the mortgage application process. This guide will provide you with detailed, clear instructions to help you accurately complete the form and submit it efficiently.

Follow the steps to successfully complete your application form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with entering the mortgage amount being requested, the interest rate, and the term for which the loan is sought. Make sure to fill these fields accurately as they directly impact your application.

- Provide the subject property address, including street, city, state, and ZIP code. Ensure that the address is correct to avoid delays in processing your application.

- If necessary, include a legal description of the subject property in the designated section. If the description is lengthy, you can attach it as a separate document.

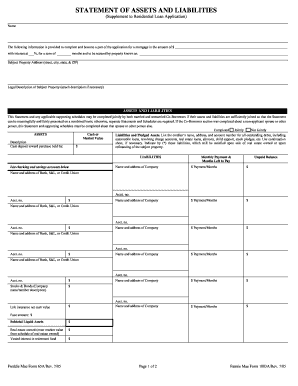

- In the 'Assets and Liabilities' section, indicate whether you are completing the statement jointly with another co-borrower or not. Choose the appropriate option that applies to your situation.

- List all assets under the 'ASSETS' section, including cash, checking, and savings accounts. For each asset, provide the market value and relevant details, ensuring you provide accurate figures.

- In the 'LIABILITIES' section, list all outstanding debts, such as loans and credit accounts. Provide details for each entry, including the creditor's name, account number, and unpaid balance.

- Check for any liabilities that will be satisfied upon the sale of real estate owned and mark them accordingly. Include any job-related expenses if applicable.

- Complete the 'Acknowledgement and Agreement' section, ensuring to read the statements carefully and confirm that all provided information is accurate to the best of your knowledge.

- Sign and date the form in the designated areas for both the borrower and the co-borrower if applicable. Ensure that you provide accurate contact details for any further communication.

- Once all sections are completed, you can save changes, download, print, or share the completed form as necessary to proceed with your application.

Start filling out your Freddie Mac 65A/Fannie Mae 1003A online today to streamline your mortgage application process.

Freddie Mac and Fannie Mae products provide numerous benefits to borrowers, including competitive interest rates and flexible lending guidelines. They help promote affordable housing options, making homeownership accessible to more individuals and families. Understanding the specific advantages of each can inform your choices in the lending process. US Legal Forms offers valuable insights and documentation options for those exploring Freddie Mac 65A and Fannie Mae 1003A.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.