Loading

Get Etrade Ira Distribution Request Form 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ETrade IRA Distribution Request Form online

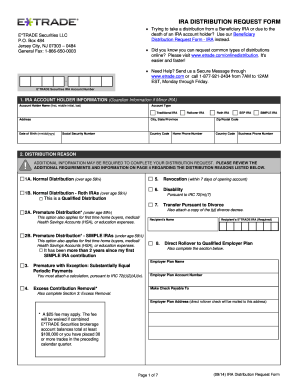

The ETrade IRA Distribution Request Form is an essential document for individuals seeking to access funds from their Individual Retirement Accounts. This guide provides clear and detailed instructions on how to complete the form online, ensuring a smooth and efficient process.

Follow the steps to fill out the ETrade IRA Distribution Request Form online.

- Click the ‘Get Form’ button to acquire the ETrade IRA Distribution Request Form and open it in your preferred editor.

- Complete the first section titled 'IRA Account Holder Information.' Here, provide your account type, name, date of birth, social security number, address, and contact numbers.

- Move to 'Distribution Reason.' Select the appropriate reason for your distribution such as normal distribution, premature distribution, or direct rollover. Be aware that additional information may be required based on your selection.

- If you selected 'Excess Contribution Removal,' fill out the section by indicating the tax year to which the excess contributions apply and specify your request for refunding or applying the excess.

- In the 'Method of Distribution' section, specify how you want the distribution to be handled, including options for one-time payments or installment payments with relevant details.

- Provide your payment instructions. Choose your preferred method such as check, direct deposit, or wire transfer and fill in the necessary bank information where applicable.

- Indicate your withholding election for federal and state taxes. Decide whether to withhold taxes from your distribution amount and complete the corresponding sections.

- Sign and date the form in the 'Signatures' section. This certification affirms that all provided information is accurate and that you understand the associated rules.

- Once all sections are completed, you can save changes, download the form for your records, print it out, or share it as needed.

Complete your ETrade IRA Distribution Request Form online today for a hassle-free withdrawal process.

Related links form

You cannot borrow from your ETrade IRA as this option is not typically allowed under IRS rules. Instead, if you need funds, you will have to make a withdrawal, which will be processed via the ETrade IRA Distribution Request Form. It’s best to consult a financial advisor to discuss your options before considering any withdrawals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.