Loading

Get Form 928

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 928 online

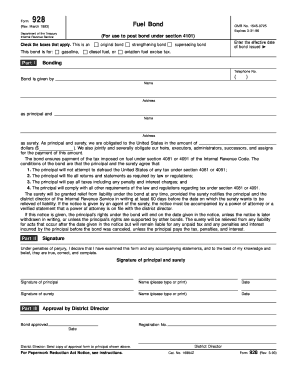

This guide provides clear and structured instructions for filling out Form 928, which is necessary for posting a bond under section 4101 of the Internal Revenue Code. By following these steps, users will be able to complete the form accurately and confidently.

Follow the steps to fill out Form 928 online successfully.

- Click ‘Get Form’ button to access the form and open it in your preferred online editing tool.

- In Part I, select the type of bond you are posting by checking the appropriate box for gasoline, diesel fuel, or aviation fuel excise tax. Enter the effective date of the bond.

- Provide detailed information regarding the bonding applicant by listing their name, address, and telephone number. Make sure this information is accurate and up-to-date.

- Fill in the name and address of the surety who will back the bond. This is important for verification and compliance purposes.

- Indicate the total amount of the bond in dollars. This must be in line with the estimates and required values based on the type of fuel and anticipated tax liabilities.

- Review the bond conditions stating that the principal agrees to comply with tax laws and regulations under sections 4081 and 4091. It's essential to understand these obligations before proceeding.

- In Part II, both the principal and surety must provide their signatures, names, and the dates of signing. This indicates their acknowledgment of the bond's terms and conditions.

- In Part III, wait for the district director's approval. The bond approval number and date will be filled out by the district director.

- Once you have completed and reviewed the form, you can save your changes, download, print, or share the completed Form 928 for submission to the relevant district director.

Start filling out your Form 928 online today to ensure compliance with tax regulations!

How to claim insolvency on your taxes. To claim insolvency, you'll need to fill out IRS Forms 1099-C and 982. These forms should be filed with your federal income tax return for any year in which a discharge of indebtedness was excluded from your income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.