Loading

Get Gst Rfd 01 Format In Excel

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst Rfd 01 format in Excel online

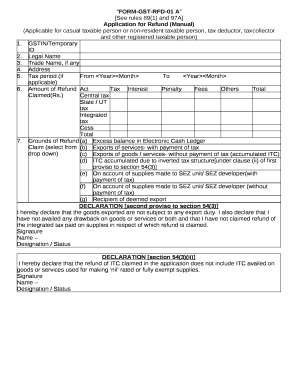

This guide aims to help users efficiently complete the Gst Rfd 01 format in Excel for refund applications. It provides clear, step-by-step instructions tailored for various users, ensuring a comprehensive understanding of each section of the form.

Follow the steps to fill out the form accurately and effectively

- Click ‘Get Form’ button to access the Gst Rfd 01 format and open it in your preferred Excel tool.

- Begin by entering the GSTIN or temporary ID in the designated field to identify your registered status.

- Input your legal name and, if applicable, your trade name in the respective fields for accurate record-keeping.

- Provide your address, ensuring that all details are correct for communication purposes.

- Specify the tax period by selecting the relevant start and end dates in the fields provided.

- Detail the amount of refund being claimed, breaking it down into categories such as tax, interest, penalty, fees, and others to sum up the total refund amount.

- Select the grounds for the refund from the drop-down menu, ensuring to choose the reason that accurately reflects your situation.

- Complete the declaration sections by providing signatures and names, ensuring they reflect your current designation or status.

- If applicable, fill out the annexures for specific refund types, ensuring calculations are performed accurately and documented correctly.

- Before finalizing, review all information for completeness and accuracy, then save your document.

- Once satisfied, you can download, print, or share the completed form as needed.

Start completing your Gst Rfd 01 format in Excel online today!

Completed the process of filing the refund application in Form GST RFD-01. Uploaded all the supporting documents / undertaking / statements / invoices. The amount has been debited from the electronic credit/cash ledger if required.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.