Get Mtc Uniform Sales & Use Tax Exemption Resale Certificate 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MTC Uniform Sales & Use Tax Exemption Resale Certificate online

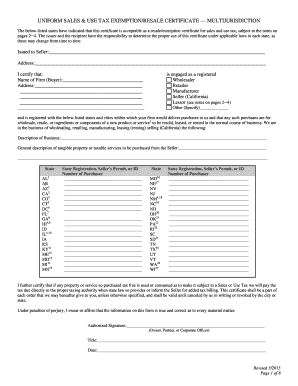

The MTC Uniform Sales & Use Tax Exemption Resale Certificate serves as a crucial document for buyers seeking to avoid sales tax on eligible purchases. This guide provides a clear, step-by-step approach to accurately completing the form online, ensuring compliance with applicable laws.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the 'Issued to Seller' section with the name of the seller and their address. This identifies the seller from whom the purchases will be made.

- In the 'Buyer' section, enter the name of your firm, your address, and any additional details required about your business or the nature of the purchase.

- Indicate your business type by selecting from options such as wholesaler, retailer, manufacturer, or other. Ensure this accurately reflects your business operations.

- Provide a description of the business activities and specify the general types of tangible property or taxable services you intend to purchase tax-free from the seller.

- In the state registration section, fill out the State Registration, Seller's Permit, or ID number for each relevant state where you are making purchases or where your business is registered.

- Sign and date the form at the bottom, certifying that the information provided is true and accurate. This section may only be completed by an authorized individual from your organization.

- Once all fields are completed, ensure to save the document. You may then download, print, or share the form as required.

Start filling out your MTC Uniform Sales & Use Tax Exemption Resale Certificate online today!

Get form

To obtain a Texas sales and use tax resale certificate, you must complete the application provided by the Texas Comptroller's office. After filling out the necessary form, you can submit it to the appropriate department. The MTC Uniform Sales & Use Tax Exemption Resale Certificate can be applied in Texas, allowing you to make purchases without incurring sales tax when you plan to resell the items.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.