Loading

Get Nv App-01.00 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV APP-01.00 online

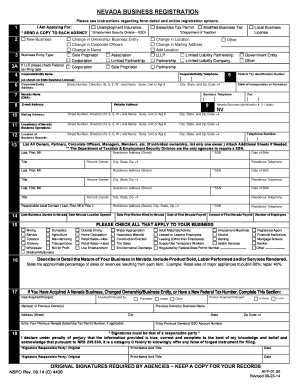

Filling out the NV APP-01.00 form is a crucial step for businesses looking to register in Nevada. This guide provides straightforward instructions to assist users in completing the form accurately and efficiently in an online environment.

Follow the steps to complete the NV APP-01.00 online.

- Press the ‘Get Form’ button to access the NV APP-01.00 form and open it in the document editor.

- Begin with section 1, indicating the type of application you are submitting. Check the relevant boxes for the agencies you intend to notify.

- In section 3, specify your business entity type. If you identify as an LLC, ensure to denote your federal tax filing type in section 3A.

- Complete section 4 by entering your corporate or entity name as registered with the state. Be sure to include a valid telephone number.

- In section 5, input your federal tax identification number. If you do not have one yet, indicate 'PENDING'.

- Provide your corporate/entity address in section 6, making sure to include the complete address, including state and zip code.

- Fill out section 7 to include your Nevada name (DBA) along with business phone and fax numbers.

- Input your email address and website address in section 8.

- For section 9, enter your Nevada business ID number as stated on your state business license.

- Section 10 requires you to provide your mailing address, which will be used for official correspondence.

- Indicate your business operations' location in section 11, including all necessary identifying details.

- Provide the location where your business records will be maintained in section 12.

- List all relevant owners, partners, and corporate officers in section 13, ensuring to provide required personal information.

- Section 14 involves entering significant dates related to your business operations in Nevada.

- Identify the nature of your business in section 16 by describing the goods or services provided along with estimated sales percentages.

- If applicable, complete section 17 regarding any changes to ownership or business structure.

- Finally, ensure that section 18 is signed by an authorized party and date the form accurately.

- Review all the information entered for accuracy before saving changes, downloading, printing, or sharing the completed form.

Start filling out the NV APP-01.00 form online today to ensure your business is registered correctly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To register for Nevada sales tax, businesses must complete a sales tax application with the Nevada Department of Taxation. The application can typically be completed online, where you'll provide necessary business details. Utilizing resources from NV APP-01.00 can streamline the registration process. Ensuring proper registration is critical for compliance with state sales tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.