Loading

Get Ks Sos Np 50 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS SOS NP 50 online

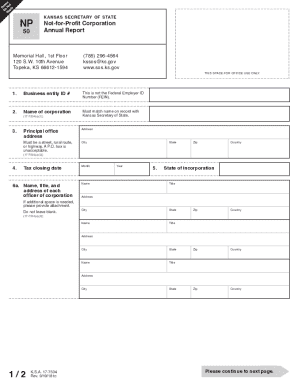

Completing the KS SOS NP 50 form, which is the annual report for not-for-profit corporations, can be done efficiently online. This guide provides clear, step-by-step instructions to ensure you fill out the form accurately and effectively.

Follow the steps to successfully complete the KS SOS NP 50 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first field, enter the business entity ID number. This should not be confused with the Federal Employer ID Number (FEIN).

- Input the name of the corporation, ensuring it matches the name on record with the Kansas Secretary of State.

- Provide the principal office address. This must be a valid street address; P.O. boxes are not acceptable.

- Select the tax closing date, entering the month and year of the corporation's tax closing.

- List the names, titles, and addresses of each officer of the corporation. If additional space is required, attach an extra document.

- Specify the governing body by listing names and addresses of its members. Leave this blank if the governing body members and officers are the same.

- If applicable, enter the Federal Employer Identification Number (FEIN), though this is not mandatory.

- Answer question eight or nine regarding the total number of shares of capital stock issued or memberships, respectively, ensuring the response is numeric.

- Respond to question 10 about equity ownership in other business entities. If applicable, provide names and IDs of those entities.

- Indicate whether the corporation owns or leases land suitable for agricultural use by answering question 11.

- Sign the document at question 12, confirming under penalty of perjury that the information provided is true and correct.

- Review all the entered information for accuracy and completion before submitting or proceeding.

- Once completed, you can save changes, download, print, or share the form as required.

Start your online filing process for the KS SOS NP 50 form today!

Indeed, LLCs in Kansas must go through an annual renewal process which includes filing an annual report and paying any required fees. This must be done in line with the KS SOS NP 50 to keep your entity legally compliant. It's crucial to meet these deadlines to avoid potential administrative dissolution. By staying proactive, you can ensure the continued operation of your LLC without unnecessary interruptions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.