Loading

Get Sc Uce-1010 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC UCE-1010 online

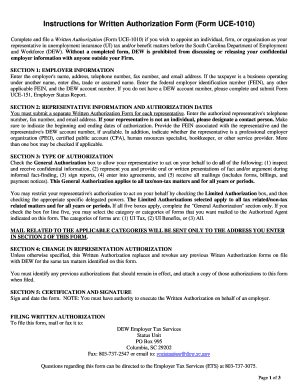

This guide provides essential instructions for completing the SC UCE-1010 online. This form is necessary for appointing a representative to assist with unemployment insurance matters before the South Carolina Department of Employment and Workforce.

Follow the steps to complete the SC UCE-1010 online effectively.

- Press the ‘Get Form’ button to access the SC UCE-1010 form and open it in the editor.

- In Section 1, provide the employer's name, address, and contact details including telephone number, fax number, and email. If applicable, include the doing business as (DBA) name and the federal employer identification number (FEIN). If you do not have a DEW account number, consider submitting Form UCE-151.

- Move to Section 2 to enter the authorized representative’s information. If your representative is an organization, include the name and a contact person. Make sure to fill in their telephone number, fax number, and email address. Specify the beginning and ending dates of authorization and include the representative's FEIN and DEW account number if available. Indicate their professional role by checking the applicable boxes.

- In Section 3, select the type of authorization. For a general authorization, check the box provided. If selecting limited authorization, indicate the specific delegated powers by checking the appropriate boxes. Choose the categories of forms you wish for DEW to send to your representative based on your selections.

- Proceed to Section 4 to indicate any changes in representation authorization. This form will replace any previous forms unless specifically noted otherwise. Attach copies of any relevant previous authorizations.

- In Section 5, ensure to sign and date the form. Confirm you have the authority to execute the Written Authorization on behalf of the employer.

- Finally, after completing the form, you can save your changes, download, print, or share the form as necessary. Ensure to submit the completed form to the DEW Employer Tax Services through the specified mailing address, fax, or email provided in the filing instructions.

Complete your documents online today for a streamlined process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In South Carolina, several factors can disqualify you from receiving unemployment benefits. For instance, if you voluntarily quit your job without good cause or are discharged for misconduct, you may be ineligible. Additionally, failure to actively seek work can impact your eligibility. Utilizing the SC UCE-1010 form can help ensure you understand the requirements and stay compliant.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.