Loading

Get Form Gst Apl 01 In Word Format Download

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Gst Apl 01 In Word Format Download online

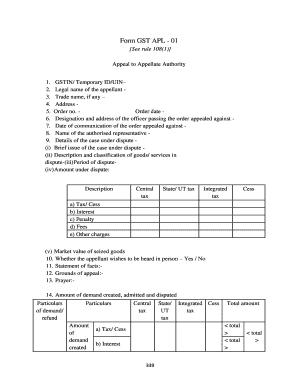

Filling out the Form Gst Apl 01 is an important step for individuals seeking to appeal to the Appellate Authority. This guide provides clear, step-by-step instructions to help users complete the form with confidence, ensuring all necessary information is provided accurately.

Follow the steps to fill out the Form Gst Apl 01 successfully.

- Click the ‘Get Form’ button to obtain the form and open it in your word processor.

- Begin filling in 'GSTIN/Temporary ID/UIN,' ensuring that you enter your identification number accurately.

- Provide the 'Legal name of the appellant' and the 'Trade name, if any,' in the respective fields.

- Input your 'Address,' ensuring correct formatting and completeness.

- Enter the 'Order number' and 'Order date' as mentioned in the communication from the authority.

- Fill in the 'Designation and address of the officer' who passed the order appealed against.

- Specify the 'Date of communication of the order appealed against' for clarity on the timeline.

- Complete the section for 'Name of the authorised representative,' if applicable.

- Detail the 'Case under dispute,' providing a 'Brief issue' and classification of goods/services involved.

- Fill in the 'Period of dispute' followed by the total 'Amount under dispute,' detailing Central tax, State/UT tax, Integrated tax, and any Cess.

- Indicate whether you wish to be heard in person by selecting 'Yes' or 'No' in the appropriate section.

- Provide a comprehensive 'Statement of facts,' outlining important details relevant to your case.

- Outline your 'Grounds of appeal' clearly and concisely.

- Complete the 'Prayer' for what you wish the authority to consider or grant.

- Finalise the details of the demand created, admitted, and disputed, ensuring all amounts are accounted for.

- Review your completed form thoroughly for any errors or omissions.

- Save your changes, then download, print, or share the completed form as needed.

Begin filling out the Form Gst Apl 01 online today for a seamless appeal process.

By submitting DRC-07 to GSTN, liability against the tax payer will be created in part B {other than return related liability} of the Liability Ledger. You can appeal against this order u/s 107 of the Act, within three months from the date on which the said decision or order is communicated you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.