Loading

Get Mhil Loan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mhil Loan online

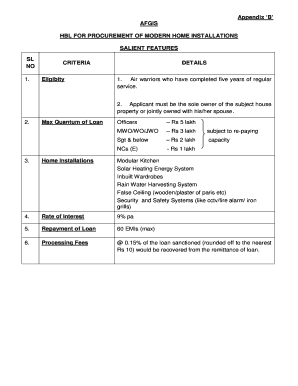

This guide provides clear, step-by-step instructions on how to complete the Mhil Loan application online. Designed for users of all experience levels, the guide ensures that you understand each section of the form thoroughly.

Follow the steps to successfully fill out the Mhil Loan application.

- Click the ‘Get Form’ button to access the Mhil Loan application form. This will allow you to open the document in an available online editor.

- Begin by entering your personal details including service number, rank, name, and branch/trade. Ensure all information is accurate and complete.

- Specify your date of enrolment and provide your commission type if applicable. Fill in your date of birth and expected retirement or discharge date.

- Input your gross emoluments and deductions. Attach a self-attested printout of your latest e-payslip as proof of income.

- Provide your bank account details, including account number, bank name, branch, IFSC code, and MICR code. Attach a photocopy of the front page of your passbook or a cancelled cheque.

- Clearly state the anticipated total cost of the modern home installations and the amount of loan required. Justify your repayment plan by indicating the EMI you can afford.

- Attach the required documents, including a proforma invoice from the dealer, registered sale deed photocopy, and any other necessary certifications as indicated in the instructions.

- Complete the agreement section of the application, ensuring it is duly signed and witnessed. Both applicant and witnesses should consent to the terms stated in the agreement.

- After reviewing all entries for accuracy, save your changes. You can then download, print, or share your completed application as needed.

Complete your Mhil Loan application online now to benefit from modern home installations.

Get Your Credit Score. Credit scores help lenders determine who qualifies for loans, and the interest rates they'll pay. ... Consider Mortgage Types. ... Review Financing Options. ... Contact Several Lenders. ... Add in the Additional Costs. ... Negotiate. ... Get It in Writing. ... Picking the Best Rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.