Loading

Get Payable On Death Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payable On Death Form online

Filling out a Payable On Death Form is an important step in ensuring that your assets are distributed according to your wishes. This guide will provide you with clear, step-by-step instructions on how to complete the form online, making the process straightforward and accessible for everyone.

Follow the steps to fill out the Payable On Death Form with ease.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

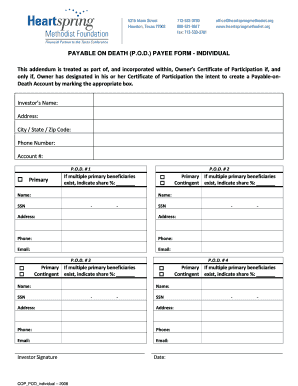

- Enter the investor's name in the designated field. Ensure that the name is accurate and matches any identification documents.

- Fill in the address, including city, state, and zip code, in the appropriate fields provided.

- Input the phone number to ensure that you can be contacted if any clarifications are needed.

- Provide the account number associated with the payable on death arrangement in the specified section of the form.

- List the primary beneficiaries for the account under P.O.D. #1. If there are multiple primary beneficiaries, indicate each person's share percentage.

- For each beneficiary listed, include the individual's name, Social Security number, address, phone number, and email address.

- Repeat steps 6 and 7 for additional beneficiaries under P.O.D. #2, P.O.D. #3, and P.O.D. #4, as applicable.

- Provide your signature in the designated area to affirm the information provided is accurate, followed by the date.

- Review all entries for completeness and accuracy, then save changes, download, print, or share the form as needed.

Complete your documents online today to ensure your wishes are honored.

The value of a POD account generally will not be included in your taxable income because bequests aren't taxable as income. Any income earned by the POD account prior to the date the bequeather died is reported on their final income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.