Loading

Get Santander Residential Remortgage Input Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Santander Residential Remortgage Input Form online

Filling out the Santander Residential Remortgage Input Form is a crucial step in securing your remortgage. This guide provides a clear, step-by-step approach to ensure that you complete the form correctly, making the process smoother and more efficient.

Follow the steps to complete the Santander Residential Remortgage Input Form online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

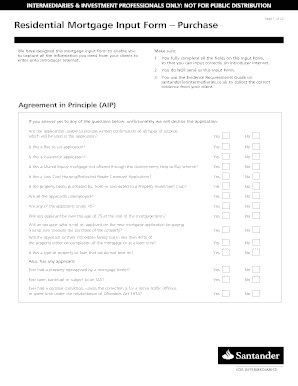

- Begin with the Agreement in Principle (AIP) section. Answer the questions regarding income confirmation, application types, and others clearly, as any 'yes' responses may lead to application declines.

- In the Application Type section, select your mortgage type and indicate whether you have a current mortgage. Specify if your application is for a single or joint claim.

- Provide detailed information about each applicant. Fill in the applicant details, including title, first name, surname, date of birth, and marital status. Ensure that you input this information accurately for both applicants.

- Next, access the Contact Details section. Include home and work phone numbers, ensuring that they are current and correct to facilitate communication throughout the application process.

- Complete the Address Details section, where you will need to provide a three-year address history for each applicant. Be sure to indicate if any of the addresses are overseas or BFPO.

- Include Employment Details for both applicants, stating the current employment status—employed, self-employed, or retired—and providing relevant job information where applicable.

- Fill in Income Details accurately. You will need to disclose both primary and secondary income sources, citing all amounts in pound sterling without rounding up.

- Review the Financial Declaration section. Confirm any past financial challenges, such as County Court Judgments or bankruptcies. If necessary, provide explanations for any 'yes' responses.

- In the Commitments and Budget Planner sections, list any current commitments and calculate your monthly budget to provide a comprehensive overview of your finances.

- Gather all necessary information regarding the Loan and Property details. This includes the property's address, purchase price, and any additional financial requirements related to the mortgage.

- Finalize all sections and review your entries for errors. Once completed, you can proceed to save the changes, download a copy, print, or share the form as needed.

Complete your Santander Residential Remortgage Input Form online today to take the next step towards securing your remortgage.

What you need to apply for a mortgage utility bills. proof of benefits received. P60 form from your employer. your last three months' payslips. passport or driving licence (to prove your identity) bank statements of your current account for the last three to six months.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.