Loading

Get Ri Ri-2210pt 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI RI-2210PT online

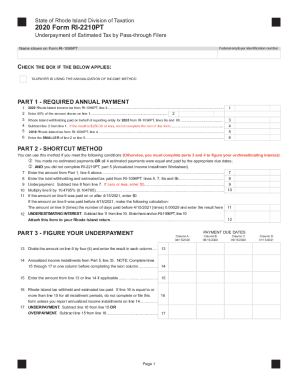

Filling out the RI RI-2210PT form is essential for pass-through filers in Rhode Island to determine if they have underpaid their estimated taxes. This guide provides clear and concise steps to assist users in completing the form accurately online.

Follow the steps to complete the RI RI-2210PT form online.

- Click ‘Get Form’ button to obtain the RI RI-2210PT form and open it in the editor.

- Begin by entering your federal employer identification number and the name shown on Form RI-1096PT at the top of the form.

- In Part 1, Required Annual Payment, fill in the Rhode Island income tax from RI-1096PT, line 4 on line 1. This is your initial data point for calculating payments.

- On line 2, calculate and enter 80% of the amount from line 1. This figure is crucial for determining your required payment.

- Line 3 requires the total Rhode Island withholding paid on behalf of the reporting entity for 2020, as found on lines 8a and 8b of RI-1096PT. Enter this amount.

- Subtract line 3 from line 1 on line 4. If this result is $250.00 or less, you may stop here, as you do not owe any further payment.

- On line 5, enter your 2019 Rhode Island tax from RI-1096PT, line 4.

- For line 6, enter the smaller value between line 2 and line 5, which is crucial for determining your potential underpayment.

- Move to Part 2 if you qualify for the shortcut method. Otherwise, proceed to parts 3 and 4 to calculate any underpayments.

- In line 7, repeat the amount from line 6 and on line 8, enter the total of withholding and estimated tax paid from RI-1096PT.

- Line 9 requires you to subtract line 8 from line 7; if this value is zero or less, enter $0.

- Follow the calculations on lines 10 to 12 as instructed to figure your potential underestimating interest.

- In Part 3, ensure to enter payment due dates based on your filing type and complete lines as specified.

- Proceed to fill out Part 4 where you will calculate the charges related to any underpayments.

- Finally, review the entire document for accuracy, then save your changes. You can download, print, or share the completed form as necessary.

Complete the RI RI-2210PT form online today to ensure your tax filings are accurate and timely.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.