Loading

Get Ms Dor 80-315 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS DoR 80-315 online

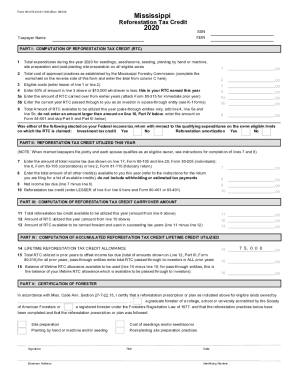

Filling out the MS DoR 80-315 form is essential for claiming the reforestation tax credit in Mississippi. This guide will walk you through each section and field of the form, making it easier for you to complete your application online.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to access the MS DoR 80-315 form so you can complete it in your browser.

- Begin filling out your personal information such as your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) and taxpayer name.

- Navigate to Part I, where you will compute the reforestation tax credit. Start by entering total expenditures for the year 2020 for seedlings, planting, and other eligible expenses on line 1.

- On line 2, record the total cost of approved practices as established by the Mississippi Forestry Commission, using the worksheet on the reverse side if necessary.

- On line 3, enter the lesser amount of either line 1 or line 2 to indicate your eligible costs.

- For line 4, calculate the tax credit earned this year by entering 50% of the amount from line 3 or $10,000, whichever is less.

- Complete lines 5a and 5b, where you will input any carryover amounts from previous years and any current year RTC passed through to you from pass-through entities.

- On line 6, add the amounts from line 4, line 5a, and line 5b to determine the total RTC available for the current year.

- Proceed to Part II and enter the total income tax due on line 7, and report all other credits available to you on line 8.

- Compute the net income tax due on line 9 by subtracting line 8 from line 7, then on line 10 enter the lesser amount of line 6 or line 9.

- In Part III, report the total reforestation tax credit available to be utilized on line 11. On line 12, enter the amount utilized this year, then calculate the carryover amount for succeeding years on line 13.

- Complete Part IV, providing details about your accumulated reforestation tax credit lifetime credit utilized.

- Finally, in Part V, certify the information provided by signing and entering the necessary details including the title, date, and identifying number.

Complete your MS DoR 80-315 form online to efficiently claim your reforestation tax credit.

Once you determine that your small business needs a Mississippi state tax ID, the most convenient channel to apply is online. You can complete the online application in a matter of minutes, then wait a few days to a few weeks for the application to fully process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.