Get Co Dr 0104cr 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO DR 0104CR online

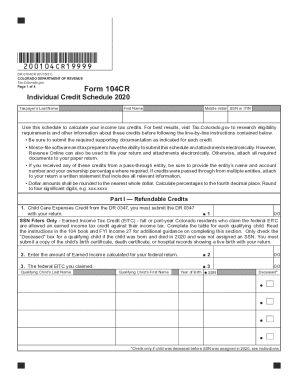

The CO DR 0104CR is an essential form for taxpayers to calculate their income tax credits in Colorado. This guide provides step-by-step instructions to help users accurately complete the form online.

Follow the steps to successfully complete the CO DR 0104CR online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your taxpayer information: fill in your last name, first name, middle initial, and either your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) at the top of the form.

- Move to Part I — Refundable Credits, and start with the Child Care Expenses Credit. If applicable, submit the DR 0347 with your return.

- For SSN filers, complete the Earned Income Tax Credit (EITC) section by listing each qualifying child's last and first name, year of birth, and SSN. Note: check the 'Deceased' box only for children who died in 2020 before receiving an SSN.

- Input the Earned Income amount calculated for your federal return, followed by the federal EITC claimed.

- Calculate the Colorado EITC by multiplying the federal EITC claimed by 10% and enter it accordingly.

- For part-year residents, continue by multiplying the CO EITC from the previous line by the percentage found on line 34 of the DR 0104PN.

- Use the worksheet provided in the 104 Book instructions to calculate the Business Personal Property Credit and submit the required documents.

- Continue to fill out any additional refundable credits as applicable, ensuring to submit necessary documentation for each credit claimed.

- After completing all sections and fields, review the Total Refundable Credits line, sum the values from applicable lines, and enter that total in the DR 0104 line 27.

- For Part II and III, follow similar instructions, ensuring to disclose all information about credits claimed for taxes paid to other states, include necessary documents, and accurately report available and used credits.

- Once all sections are completed and reviewed, save your changes. You can download, print, or share the form as needed for submission.

Complete your CO DR 0104CR online today for accurate tax credit calculations.

ing to Colorado Department of Revenue , you must file a Colorado return if you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

Fill CO DR 0104CR

Use this schedule to calculate your income tax credits. For best results, visit Tax.Colorado. Tax Credit (EITC) on DR 0104CR: Line 2 Enter the amount of earned income calculated for your federal return. ("State" includes the District of Columbia. Taxpayers must complete and submit an. Individual Credit Schedule (DR 0104CR) with their.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.