Loading

Get Al Dor 2210al 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL DoR 2210AL online

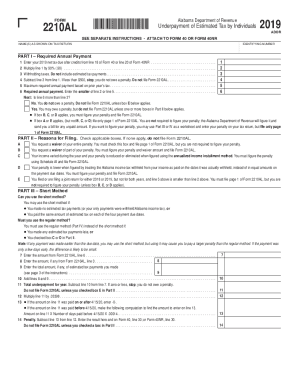

The AL DoR 2210AL is a crucial form for individuals in Alabama who may be subject to penalties for underpayment of estimated taxes. This guide will clearly outline the steps needed to complete the form online with ease and accuracy.

Follow the steps to efficiently fill out your form

- Click ‘Get Form’ button to access the AL DoR 2210AL online and open it in your editing platform.

- Begin by entering your name as it appears on your tax return in the designated field.

- Provide your identifying number, typically your Social Security number or Taxpayer Identification Number.

- For Part I, calculate your required annual payment by entering your net tax due after credits from the specified line of Form 40 or Form 40NR.

- Multiply the amount from line 1 by 90%. Enter this value on line 2.

- Report your total withholding taxes on line 3, making sure not to include estimated tax payments.

- Subtract line 3 from line 1. If the result is less than $500, you do not owe a penalty and do not need to submit Form 2210AL.

- Enter the maximum required annual payment based on the previous year's tax on line 5.

- On line 6, state the smaller value between line 2 and line 5, which represents your required annual payment.

- Indicate if the amount on line 6 exceeds the withholding tax reported on line 3 to determine if you might owe a penalty.

- If penalties are recognized, check the applicable boxes in Part II to specify the reasons for filing, if any apply to your situation.

- If you use the Short Method, follow the guidelines in Part III and ensure that no estimated tax payments are made late.

- Enter your calculations in Part IV if you choose to use the Regular Method for figuring your underpayment.

- Complete the underpayment calculations, providing totals for what is owed in the relevant sections.

- After reviewing all entries for accuracy, save your changes, then download or print the completed form to retain for your records.

Complete your AL DoR 2210AL online today to ensure timely and accurate submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file your Alabama state tax return electronically, you can use the state's free tax-filing system at My Alabama Taxes, or MAT. You can pay any tax due by using your checking account (for free) or by credit card (but there's a fee).

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.